How to Create a Household Budget: Managing Personal Finances Effectively

Managing personal finances can be a challenging task, especially when it comes to creating a household budget. A household budget is a financial plan that helps individuals and families to track their income and expenses, and to ensure that they are living within their means. With a well-planned budget, you can save money, pay off debts, and achieve your financial goals.

The Benefits of Creating a Household Budget

Creating a household budget has numerous benefits, including:

- Helping you to track your spending habits and identify areas where you can cut back

- Allowing you to set financial goals and work towards achieving them

- Helping you to avoid overspending and accumulating debt

- Giving you a sense of control over your finances

Steps to Creating a Household Budget

Creating a household budget can seem overwhelming, but it doesn’t have to be. Follow these simple steps:

- Determine your income

- List your expenses

- Categorize your expenses

- Calculate your total income and expenses

- Identify areas where you can cut back

- Set financial goals

- Track your spending and adjust your budget as necessary

Conclusion

Creating a household budget is an essential part of managing personal finances effectively. By following these simple steps, you can create a budget that works for you and your family, and achieve your financial goals.

Why You Need a Household Budget

Managing personal finances can be overwhelming, especially if you don’t have a clear understanding of your income and expenses. Creating a household budget can help you gain control of your finances and achieve your financial goals.

Understanding Your Finances

The first step in creating a household budget is to understand your finances. This means knowing exactly how much money is coming in and going out each month. You can start by gathering all your financial statements, including bank statements, credit card statements, and bills. This will give you a clear picture of your income and expenses.

Once you have a clear understanding of your finances, you can start tracking your spending. This will help you identify areas where you can cut back and save money. For example, you may realize that you’re spending too much on dining out or entertainment. By tracking your spending, you can make adjustments and allocate your money more effectively.

Identifying Your Financial Goals

Creating a household budget is not just about tracking your expenses. It’s also about setting financial goals and working towards them. Your financial goals may include paying off debt, saving for a down payment on a house, or building an emergency fund. Whatever your goals may be, a household budget can help you achieve them.

When setting your financial goals, it’s important to make them specific, measurable, achievable, relevant, and time-bound. This means setting clear objectives and timelines for achieving them. For example, instead of saying “I want to save money,” you could say “I want to save $5,000 for a down payment on a house in the next 12 months.”

By identifying your financial goals and creating a budget to achieve them, you’ll be able to make better financial decisions and stay on track towards achieving your goals.

In conclusion, creating a household budget is an essential part of managing personal finances effectively. By understanding your finances and identifying your financial goals, you’ll be able to take control of your money and achieve financial stability.

How to Create a Household Budget: Managing Personal Finances Effectively

Creating a household budget is an essential step towards managing personal finances effectively. It helps you keep track of your income and expenses, set financial goals and prioritize spending. Here are the steps to follow when creating a household budget:

Calculate Your Income

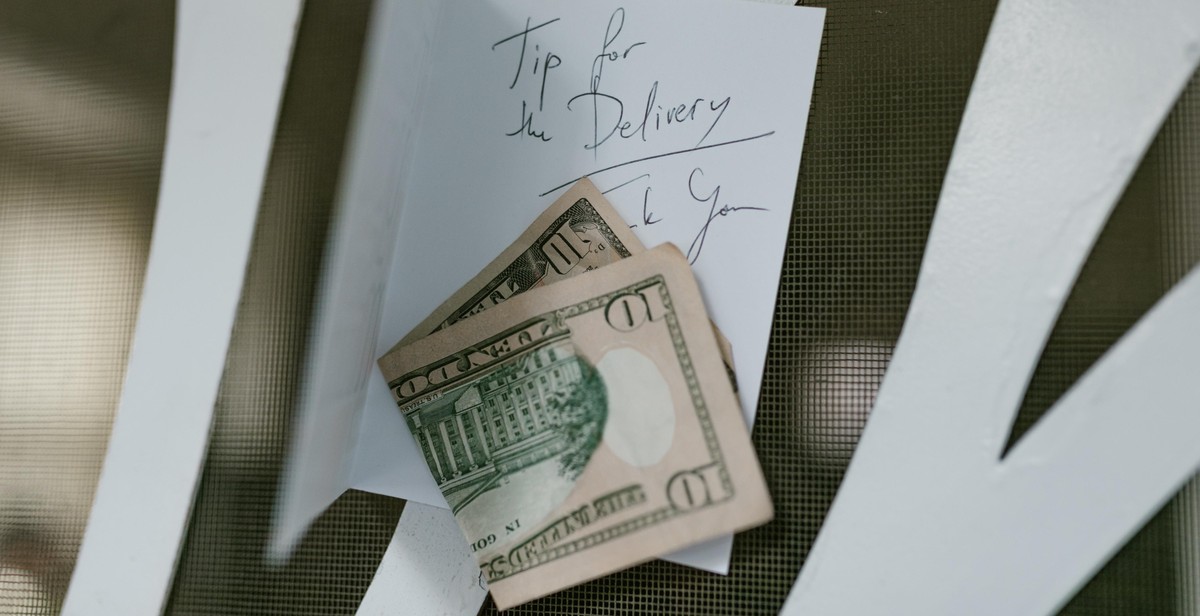

The first step in creating a household budget is to calculate your income. This includes all sources of income such as salary, wages, bonuses, tips, and any other income you receive regularly. If you have irregular income, average your income over the past few months to get a realistic estimate of your income.

Determine Your Expenses

Next, determine your expenses. This includes all your fixed and variable expenses such as rent/mortgage, utilities, groceries, transportation, entertainment, and any debt payments. It is important to track your expenses for at least a month to get a clear idea of your spending habits. This will help you identify areas where you can cut back on expenses and save money.

Set Financial Goals

Once you have a clear idea of your income and expenses, it’s time to set financial goals. Financial goals are specific, measurable, achievable, relevant, and time-bound (SMART). Examples of financial goals include paying off debt, saving for retirement, buying a home, or taking a vacation. Prioritize your goals based on their importance and the time frame in which you want to achieve them.

Create a Budget Plan

Finally, create a budget plan. This involves allocating your income towards your expenses and financial goals. Start by subtracting your expenses from your income to determine your disposable income. Then, allocate your disposable income towards your financial goals, starting with the most important ones. Use a budgeting tool or spreadsheet to help you track your progress and adjust your budget as necessary.

By following these steps, you can create a household budget that will help you manage your personal finances effectively and achieve your financial goals.

Tips for Managing Your Household Budget

Creating a household budget is just the first step towards managing your personal finances effectively. The real challenge is sticking to the budget and making sure your spending stays within the limits you’ve set for yourself. Here are some tips to help you manage your household budget:

Track Your Spending

The first step to managing your household budget is to know where your money is going. Keep track of all your expenses, including your bills, groceries, transportation, and entertainment. You can use a spreadsheet or a budgeting app to help you keep track of your spending. By knowing exactly where your money is going, you can identify areas where you can cut down on your spending and save more money.

Cut Down on Expenses

Once you’ve identified where your money is going, it’s time to look for ways to cut down on your expenses. Start by eliminating unnecessary expenses, such as subscription services you’re not using, eating out too often, or buying things you don’t really need. You can also look for ways to save money on your bills, such as switching to a cheaper phone or internet plan, or negotiating with your service providers for better rates. By cutting down on your expenses, you can free up more money to put towards your savings or pay off debt.

Save for Emergencies

One of the most important things you can do to manage your household budget is to save for emergencies. Unexpected expenses can happen at any time, such as a medical emergency, car repair, or job loss. Aim to save at least three to six months’ worth of living expenses in an emergency fund. This way, you’ll be prepared for any unexpected expenses that come your way, without having to dip into your regular savings or go into debt.

With these tips, you can effectively manage your household budget and take control of your personal finances. Remember to track your spending, cut down on expenses, and save for emergencies, and you’ll be well on your way to financial stability.

Conclusion

Creating a household budget is an essential step towards managing personal finances effectively. It helps to keep track of income and expenses, prioritize spending, and save money for the future. With the right approach, anyone can create a budget that works for them.

Key takeaways

- Start by tracking your income and expenses for a few months to get an accurate picture of your spending habits.

- Identify areas where you can cut back on expenses, such as dining out or subscription services.

- Set realistic financial goals, such as paying off debt or saving for a down payment on a home.

- Use a budgeting tool or app to help you stay on track and monitor your progress.

- Be flexible and willing to adjust your budget as needed to accommodate changes in your income or expenses.

Benefits of creating a household budget

When you create a household budget and stick to it, you can enjoy a variety of benefits, including:

- Reduced financial stress and anxiety

- Improved ability to save money for emergencies and long-term goals

- Increased awareness of your spending habits and areas for improvement

- Greater control over your finances and the ability to make informed financial decisions

Start creating your household budget today

Don’t wait any longer to take control of your personal finances. Start creating your household budget today and enjoy the peace of mind that comes with knowing you are managing your money effectively.